While our feeds have been flooded with news and developments on COVID-19, other disruptive events have subtly moved their way into people’s lives like an unexpected storm.

It seems like only yesterday celebrities, news outlets and hashtags around the world directed their reach on the Australian bush fires that would cost the country up to $101 billion in property damage and economic loss. 46 million acres of land was burnt, killing at least 34 people, hundreds of millions of wildlife, and billions of vertebrate species. This historical destruction all seems like a bad bonfire now that focus shifts to COVID-19.

This is not news, and blame should not be put on the general population’s attention span. But professionals, organisations and those in the public space need to strongly consider the extent of other events occurring alongside COVID, because they are!

This year alone, RiskLogic has supported dozens of clients deal with major cyber-attacks, loss of key staff, natural disasters, supply-chain disruptions, ransomware attacks and disruptive large gatherings and protests to name a few.

As we round up the year, we will dissect other events in a mini-series dedicated to parallel crisis events, these we will cover:

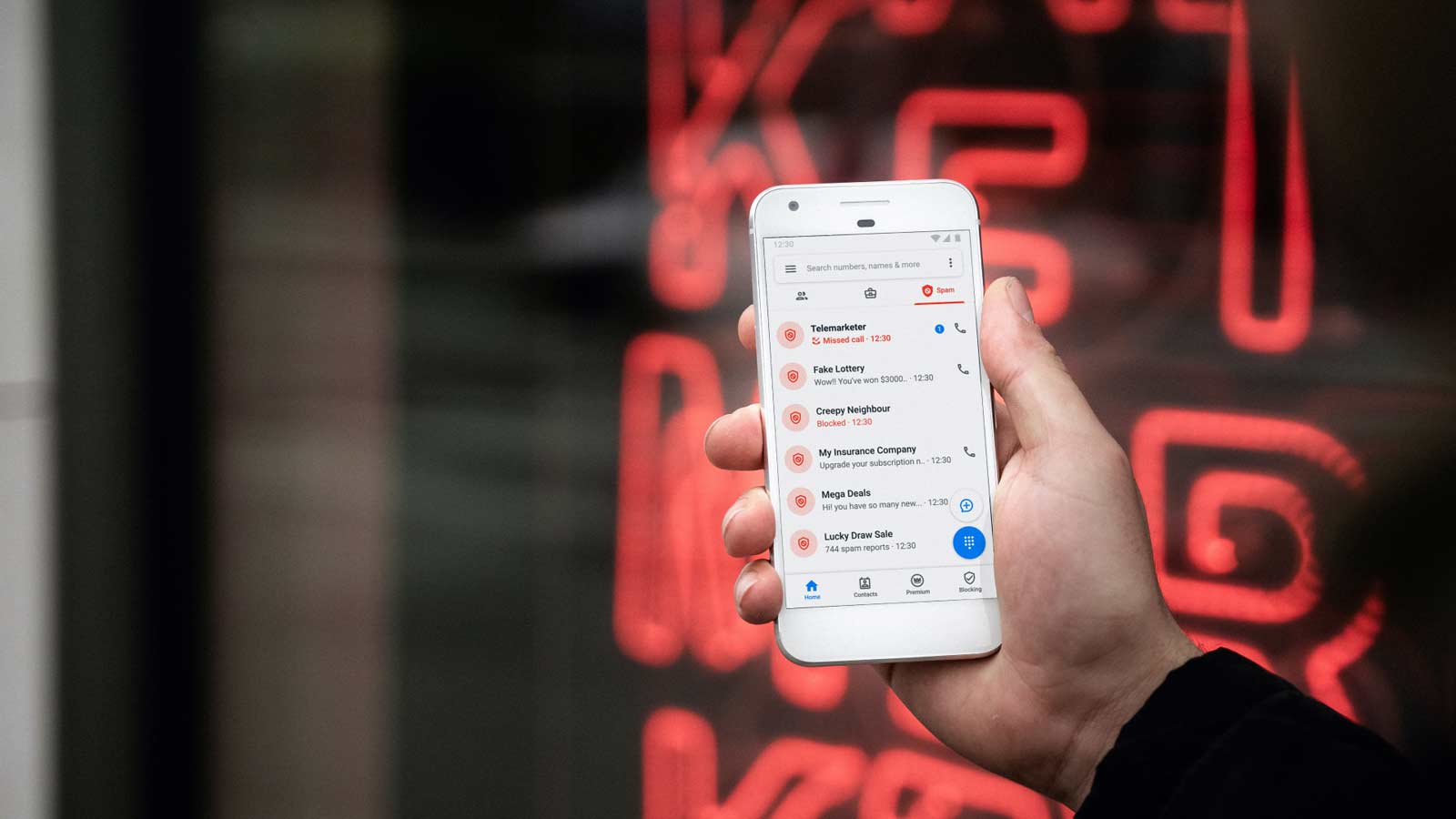

- The variety of scams that have appeared and increased during the pandemic

- An overview of other incidents happening during COVID

- A discussion on incidents that you would seldom anticipate (like virtual kidnapping)

At the very least, we hope this provides a break from the bombardment of COVID related updates.

Virtual kidnapping is happening right now

Virtual kidnapping is an extortion scam that has historically targeted Chinese international students in Australia.

The scam targets individuals with threats of deportation, before forcing them to contact their families for significant sums of money. The NSW Police reported 8 cases in the 2018-2019 period, but they believe the real numbers are in their hundreds (with families generally too nervous or ashamed to reach out to foreign authorities). Millions of dollars have been confirmed to have been paid to the culprits; $3.2 million AUD since September 2019.

While the restriction of travel caused many international students to become somewhat stranded in foreign locations, it is believed this has contributed to a spike in cases.

What is virtual kidnapping and how does it work?

Virtual kidnapping is an extortion scheme that tricks victims into paying a ransom for a loved one who they believe is being threatened with violence or death.

The scam commences with a phone call from someone pretending to be from the Chinese Embassy, asking for personal details – usually pertaining to passports or visa status. The call then escalates to threats, with the victim being accused of participating in criminal activity before being threatened with warrants from a fake international criminal police organisation.

They are then told the only way to save themselves and their loved ones is to hand over bank account details or significant sums of money.

The scheme gained traction in 2015 when it spread from Taiwan to Western countries and has rapidly evolved with the spread of technology.

Recently, we have seen virtual kidnapping attacks occur at several Australian Universities including UNSW and unconfirmed Victorian universities, which have both reported dozens of instances of the scam occurring.

For Australia, the scam appears to be largely targeting students in NSW and Victoria, with police in both states confirming that victims often do not contact the police after they have been scammed as they often feel ashamed.

As such, police are unable to confirm accurate numbers of virtual kidnapping victims.

The kidnappers are purposely targeting Chinese International students and are communicating in Mandarin – making investigators believe that the bulk of attacks are coming from a crime syndicate located on Kinmen Island, off the coast of Taiwan.

RiskLogic has additionally seen in Australia a rise in students staging the kidnappings themselves to obtain additional money from their families, although we can’t confirm whether this is related.

Chinese and Taiwanese International students are being targeted because they are far away from home, making it more difficult for their parents to confirm whether they have been kidnapped or not.

The AFP (Australian Federal Police) had reported 54 confirmed instances of these kidnappings – however they believe that the actual number could have been in the hundreds in 2020.

Why should this matter to you?

The AFP believes that hundreds of instances have occurred throughout Australia, Europe, America and Canada, showing that virtual kidnapping can happen anywhere.

In pre-COVID Australia, international students made up more than a quarter of enrolments at universities, with the approximate number of international students in the country sitting at around 542,054 in 2019.

Chinese students made up 31% of this number and accordingly were the largest contributing country to Australia’s international student population.

These international students contributed around $32.2 billion to the Australian economy per year, according to the Australian Bureau of Statistics, with the vast majority being enrolled in universities. The associated fees and living expenses represented Australia’s third largest export (currently behind coal and iron ore) a figure that had increased 22% since 2016.

Whilst COVID has almost halved the number of International Students currently residing in Australia, the economic impacts of the virus have also seen a significant increased the rate of scams. The AFP therefore reports that the increase in financial demands seen via the scam has increased significantly.

Despite most virtual kidnapping attacks originating from Taiwan, the reputational damage the attacks cause is targeted directly at Australian Universities and their perceived inability to ensure the safety of Chinese international students.

The inability of a university to adequately or appropriately manage the virtual kidnapping of one of their students could therefore result in reputational damage to the institution. Leading to significant financial impacts if this reputational damage translates into Chinese students no longer deeming the university safe, and therefore opting for alternate universities.

For those not in the education space, it is perhaps only a matter of time until these types of threats reach a wider variety of organisations. For more public facing entities, this could be a real risk.

Furthermore, this incident (that few could have anticipated) should be evidence that the threat landscape is forever changing.

What is most likely to happen during a kidnapping?

The AFP reports that the average amount of money handed to kidnappers is $38,000, with a total estimated handover of $10 million occurring in 2018.

Already in 2020, the NSW Police have confirmed that millions of dollars have been sent. Cases report sums between $20,000 and $500,000 being sent, and even one reaching $2 million.

This amount of money is significantly higher than the average amount obtained through other types of scams.

Serious emotional and psychological impacts to the victims and potential reputational damage to the universities can occur.

What you should do if this occurs to you?

The AFP suggests that Chinese students in Australia protect themselves by doing the following:

- If you get cold called by someone making threats about arrest or deportation, it is a scam. Do not send them any money. Instead, hang up the phone immediately and report it to your local police.

- Never give your personal, credit card or online account details over the phone unless you made the call, and the phone number came from a trusted source.

– Banks or financial institution will never ask you for your card details, even when you’ve called them. These institutions have access to your personal details once you provide a security check and do not need to ask. - If you think you have provided your bank account details to a scammer, contact your bank or financial institution immediately and give them as much detail as possible

– Top tip: research your bank’s fraud and security phone number and email now. Put this in your phone in case you need to get immediate access (these are often found on the back of your bank cards too). - When dealing with uninvited contacts from people or businesses, whether it’s over the phone, by mail, fax, email, in person or on a social networking site, always consider the possibility that the approach may be a scam.

- You can contact IDCARE(a national identity and cyber support service) for support if you have concerns about your identity being compromised. Contact them via the online form or phone: 1300 432 273.

The Scamwatch website has information about scams in Chinese languages.

Further resources and instances in the news

- Families have lost millions of dollars in a virtual kidnapping scam targeting Chinese students in Australia

A 2020 update on the instances of virtual kidnapping scams as they increase in frequency and seriousness ➜ Read more

- Australian university students preyed on by terrifying kidnapping scam

An article looking at the impact that the virtual kidnapping can have on parents of the victims and concentrating on the history of the scam and its origin in Taiwan. The article goes on to confirm that the advantage of these scammers targeting victims in Australia is that the distance between the victim and their family increases the difficulty in confirming that the victim is actually safe and well, and that no charges have been laid against them by the Chinese Government ➜ Read more

- Student loses $500,000 in phone scam that’s still active

A report on one Chinese student in Australia who transferred $500,000 to virtual kidnapping scammers. The victim was eventually found by the Australian Ferderal Police 10 days after she was first contacted by the scammers ➜ Read more

- AFP Scam Warning for Virtual Kidnapping ➜ Read more